Forecast for public finances: structural challenges for Confederation and social security funds

Bern, 21.10.2025 — The latest forecasts of the Federal Finance Administration (FFA) through to 2029 show a mixed picture for Switzerland's public finances. The Confederation's financial situation remains tight and is largely dependent on the implementation of the planned relief package 27. The cantons are likely to continue to generate surpluses thanks to stable receipts overall, while the municipalities are set to post small structural deficits. There is considerable uncertainty for the social security funds, especially in connection with the financing of the 13th monthly AHV pension payment. Counter-financing for this has been planned from 2027 onward, but it has not yet been decided.

The FFA's Financial Statistics Section publishes forecasts for the public finances of the general government sector (Confederation*, cantons, municipalities and social security funds) twice a year. The current forecasts go up to 2029.

* The Confederation sub-sector comprises the parent entity, as well as separate accounts and decentralized administrative units

2024: general government surplus despite absence of SNB distribution

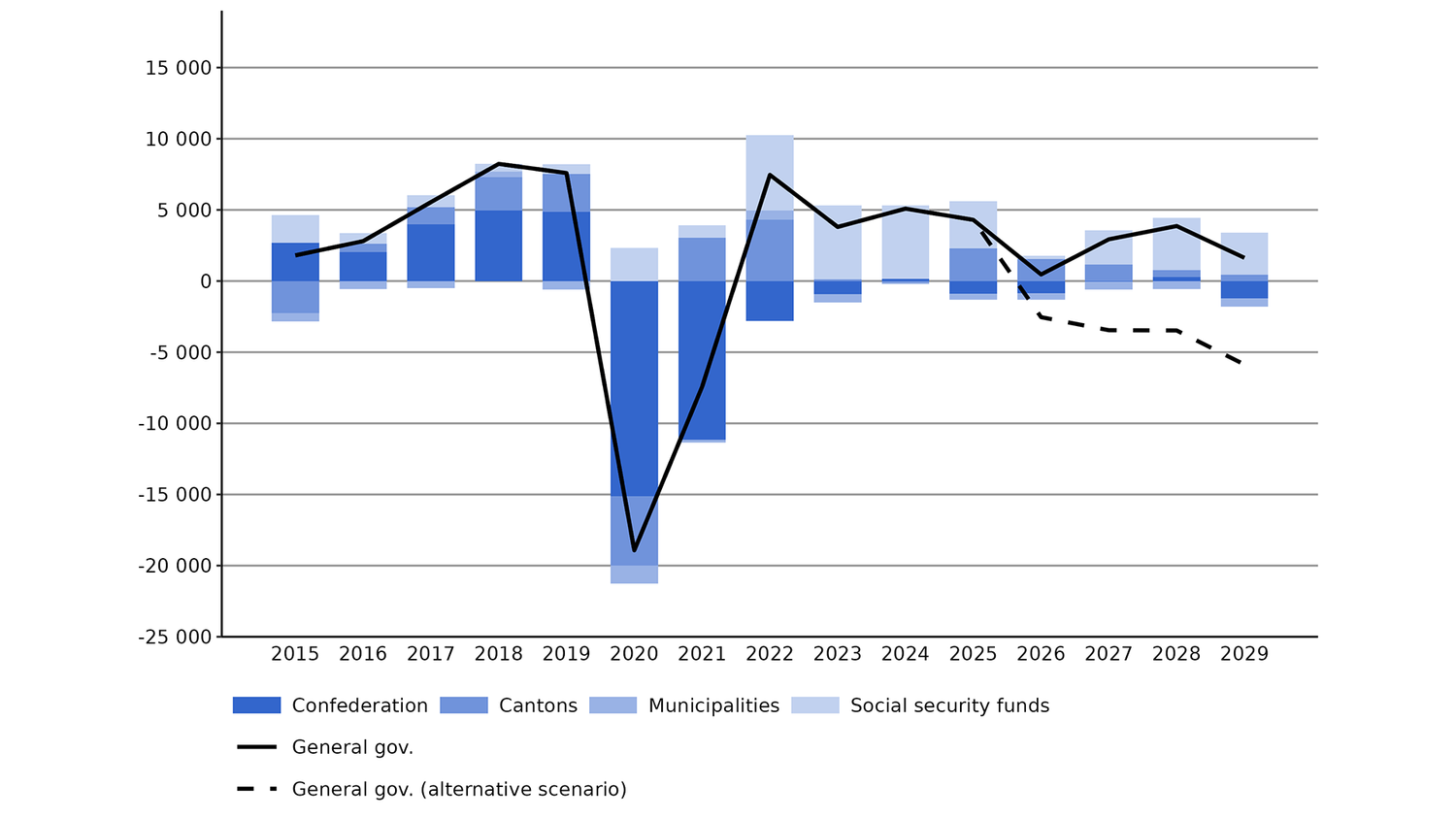

Due in particular to moderate GDP growth in 2024, the fiscal balance of all government units (excluding the social security funds) is likely to be more or less balanced, with a slight deficit of CHF 64 million. After four years with a financing deficit, the Confederation sub-sector returned to a positive fiscal balance of CHF 154 million in 2024, versus a deficit of CHF 913 million in 2023. The cantons and municipalities are likely to have moderate deficits totaling CHF 122 million and CHF 96 million, respectively, in 2024. The general government is expected to post a surplus of CHF 5.1 billion thanks to the social security funds, which have a positive balance of CHF 5.2 billion despite rising unemployment and a deterioration in the balance of unemployment insurance. The social security funds' positive result is partly due to moderate employment growth, which supports receipts. Another important factor is the AHV balance, which is benefiting from the entry into force of the measures adopted as part of the AHV 21 reform, which include an increase in VAT. The general government's net debt amounted to CHF 107.6 billion at the end of 2024, representing a year-on-year decrease of CHF 8.7 billion.

2025 forecast: falling surpluses

Compared with 2024, the general government's surplus is set to fall by around CHF 790 million to approximately CHF 4.3 billion in 2025. As economic growth is likely to be much slower in 2025 than in 2024, the Confederation's receipt growth, at 2.7%, is also expected to be lower than a year earlier (5.4%). In addition, weaker economic growth and the resulting loss of momentum on the labor market will lead to a decline in the social security funds' financing surplus.

As a result of lower receipt growth coupled with rising expenditure growth, the Confederation's fiscal balance is likely to be negative at CHF -0.9 billion in 2025, versus a financing surplus totaling CHF 2.3 billion for the cantons. The results of the Confederation and the cantons will also be supported by the SNB's profit distribution (3 bn). A negative fiscal balance totaling around CHF 400 million is anticipated for the municipalities. The general government's net debt is likely to fall further to CHF 104.3 billion.

2026 forecast: dominated by 13th monthly AHV pension payment and slower economic growth

In 2026, the general government's surplus is expected to plunge from CHF 3.8 billion to CHF 460 million. Net debt is set to stabilize and stand at CHF 103.7 billion at the end of 2026. The forecast is based on the assumption that the SNB will once again distribute CHF 3 billion to the Confederation and the cantons. However, there is considerable uncertainty concerning these distributions, due to the current market volatility. With economic growth expected to be slower than in 2025, this is likely to adversely affect the financial results of all government units. A deficit of CHF 850 million is anticipated for the Confederation, while the cantons are likely to achieve a surplus of CHF 1.5 billion, despite declining tax revenue growth. A deficit of CHF 470 million is expected for the municipalities.

In the case of the social security funds, it is projected that the fiscal balance will decline significantly year on year, going from CHF 3.1 billion to around CHF 240 million. The main factors driving this include higher expenditure for the 13th monthly AHV pension payment, which is not expected to be counter-financed until 2027, and weaker economic growth, leading to a lower expected result for unemployment insurance because of the tighter situation on the labor market.

Forecast for 2027 to 2029: development dependent on relief package 27

For the general government, surpluses of CHF 2.9 billion are expected in 2027, CHF 3.9 billion in 2028, and CHF 1.6 billion in 2029. Net debt is likely to fall to CHF 95.5 billion by the end of 2029, thus dropping below CHF 100 billion for the first time since 1995. This is due to non-administrative assets growing faster than gross debt. The forecast is based on the assumption that the SNB will distribute CHF 3 billion annually to the Confederation and the cantons. In addition, the planned federal relief measures as part of relief package 27 are taken into account. These amount to CHF 2.4 billion for 2027, CHF 3.0 billion for 2028, and CHF 3.1 billion for 2029.

If relief package 27 is implemented in full, it is anticipated that the Confederation will achieve a neutral fiscal balance in 2027 and 2028, followed by a higher deficit of CHF 1.2 billion in 2029. As the relief measures have not yet been adopted, the Confederation's fiscal balance for 2027 and 2028 involves a high degree of uncertainty. The projected deficit of CHF 1.2 billion for 2029 indicates that further action is needed to stabilize the federal budget.

In the case of the cantons, the surplus is expected to decline gradually to CHF 440 million by the end of 2029. Reductions in federal transfers to the cantons as part of relief package 27 have already been taken into account. The municipalities' fiscal balance is likely to continue to show a structural deficit, reaching a deficit of around CHF 560 million by 2029.

Based on the assumption that the labor market will recover, the social security funds' fiscal balance is also likely to improve again. A surplus of CHF 2.4 billion is expected in 2027, CHF 3.7 billion in 2028, and CHF 3.0 billion in 2029. The forecast additionally includes the assumption of a 0.7 percentage point increase in VAT to finance the 13th monthly AHV pension payment in accordance with Parliament's current resolution situation. However, this assumption is subject to considerable uncertainty, as the proposal has not yet been fully debated by Parliament and any VAT increase is subject to a mandatory popular vote.

Alternative scenario highlights risks

In order to assess the risks, an alternative scenario has also been calculated for the general government. It is assumed here that there will be no further SNB distributions from 2026 onward, that the relief package will not be introduced from 2027 onward, and that VAT will not be hiked to finance the 13th monthly AHV pension payment from 2027 onward. As a result, the general government's fiscal balance would deteriorate to CHF -5.9 billion relative to the baseline scenario in 2029 (1.6 bn). The alternative scenario does not factor in the possible impact of a change in global tariffs or the potential positive effects of additional fiscal stimulus in Europe. Furthermore, it is merely illustrative in the sense that the federal budget must comply with the debt brake even if the relief package is rejected.

General government fiscal balance (incl. alternative scenario) and by sub-sector: 2015 to 2029, FS Model

Forecast assumptions and uncertainties

The forecasts are based on the current resolutions and proposals of the Confederation, cantons and municipalities regarding budgets, status assessments and financial plans, as well as the latest forecasts concerning economic growth and SNB profit distributions. In addition, empirical values for budget underruns are taken into account on the expenditure side. The forecasts depend on several factors subject to uncertainty, including relief package 27, SNB distributions, funding for the 13th monthly AHV pension payment and the level of budget underruns. Moreover, developments in international trade policy are contributing to the high level of uncertainty. International fiscal policy in Europe (defense and infrastructure programs) and the United States (government shutdown, tax cuts) entail both upside and downside risks.

Links

The following can be found as an enclosure to this press release at www.fdf.admin.ch: