Second 2025 extrapolation confirms financing deficit

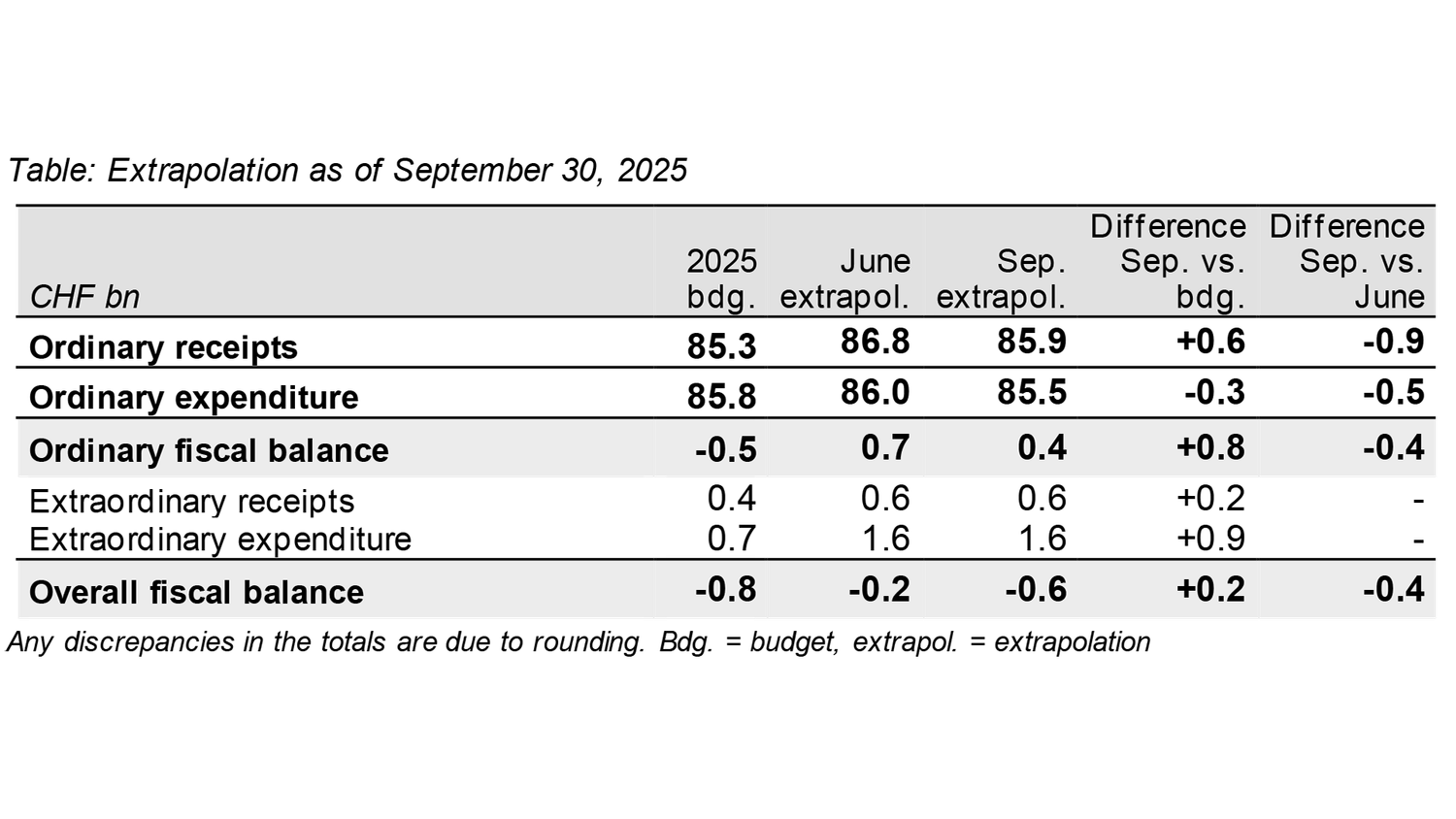

Bern, 29.10.2025 — The Federal Council took note of the current end-September extrapolation on 29 October 2025. The Confederation is reckoning on a financing deficit of CHF 0.6 billion for this year. The expected deficit is thus likely to be CHF 0.4 billion higher than forecast in the June extrapolation. However, the deficit is smaller than originally budgeted.

Based on the figures up to the end of September, the Confederation expects a financing deficit of CHF 0.6 billion for 2025. A deficit of CHF 0.8 billion had been budgeted. The slight improvement relative to the budget can be attributed to higher receipts. Compared with the June extrapolation, the financing deficit is estimated to be CHF 0.4 billion higher.

In the ordinary budget, the Confederation is now expecting a financing surplus of CHF 0.4 billion (June: 0.7 bn), meaning that the debt brake requirements will be met. The slight downward revision compared with the June extrapolation is due to lower estimates for receipts.

- The estimate for ordinary receipts has been revised downward by CHF 0.9 billion since the June extrapolation. The downward revision is attributable to lower estimated receipts from withholding tax (-0.9 bn) and direct federal tax (-0.2 bn). These stand against additional receipts of around CHF 0.1 billion each from automobile duty and stamp duty. Ordinary receipts are still higher than in the budget (+0.6 bn).

- Ordinary expenditure is expected to be down somewhat on the June extrapolation (85.5 bn instead of 86.0 bn), as supplementary credits and the estimates for credit overruns are lower. Overall, ordinary expenditure is likely to be CHF 0.3 billion below the budgeted figure.

In the extraordinary budget, the financing deficit anticipated in June remains unchanged at CHF 0.9 billion.

- The estimate for extraordinary expenditure remains unchanged at CHF 1.6 billion. This is attributable on the one hand to the capital contribution for the financial stabilization of SBB (850 mn). This had been budgeted for 2024, but the expenditure was not incurred until after the referendum period expired in 2025. On the other hand, there is extraordinary expenditure in connection with the global lump sums for people from Ukraine seeking protection (700 mn).

- The estimate for extraordinary receipts remains unchanged at CHF 0.6 billion. This includes in particular the share of the profit distribution from the Swiss National Bank (SNB) recognized as extraordinary (333 mn out of a total of 1 bn). In addition, there are one-time receipts (237 mn) due to the special SNB allocation arising from non-exchanged banknotes.

US tariffs to affect the federal budget with a lag

The new US tariffs are not expected to have any major repercussions for the federal finances this year. Depending on the consequences for future economic growth, the tariffs are likely to impact VAT in particular from 2026 onward. Further effects on receipts are to be expected with a longer lag.

Classification of the extrapolation

The Parliament Act stipulates that the Federal Council shall arrange for projections on the expected annual result to be issued as of June 30 and September 30, and shall notify Parliament thereof. The extrapolation is an estimate and thus has to be interpreted with caution.